The Ultimate Guide to a No Spend Challenge: Your Roadmap to Financial Stability and Freedom

Has the thought ever crossed your mind about how much money you spend on unnecessary items each month?

The good news is that there’s a solution: the no spend challenge.

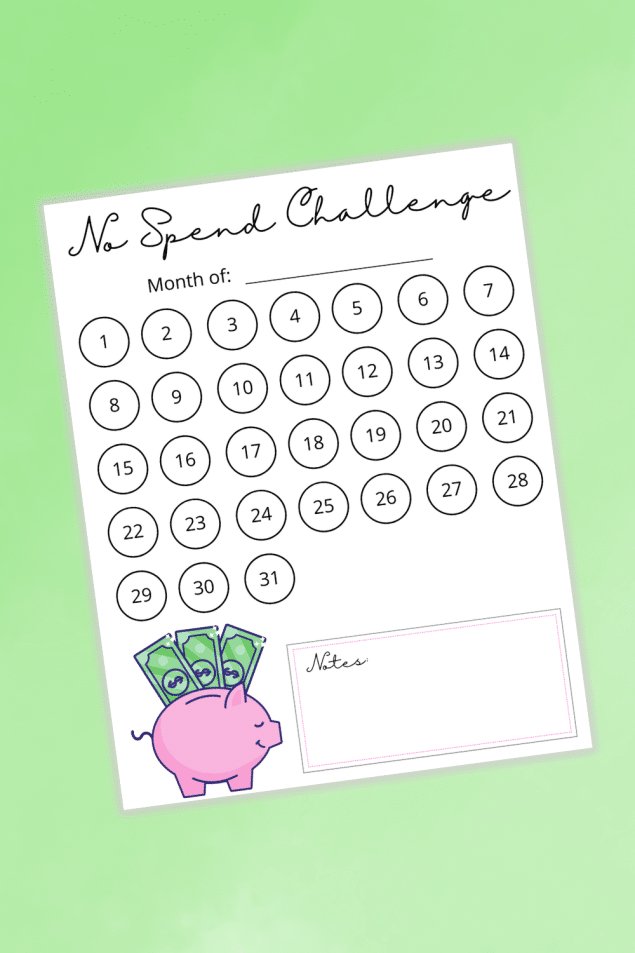

And even better? We’ve got a free printable no spend tracker for you to help keep track of your spending throughout the month.

Not only does this method help you monitor your spending habits, but it also brings you a step closer to achieving your financial goals.

FREE Activities to Take Advantage of During a No Spend Challenge

FREE Printable Savings Tracker

FREE Printable Mortgage Payoff Tracker

Why Use a No Spend Tracker?

A no spend challenge, sometimes called a no spending challenge, is precisely what it sounds like.

It’s a period of time—often a full month—where you aim to spend money only on essential monthly bills and necessities, avoiding all unneeded spending.

This challenge offers a plethora of benefits, and using a no spend tracker amplifies these benefits. But why?

- Visual Reinforcement: There’s a sense of achievement when you see more green circles (not spending) than red ones (spending) on your tracker. This visual aid is a great way to stay motivated throughout the entire month.

- Tangible Control: In the age of digital items and products, a physical product like the free printable tracker makes a difference. It serves as a daily reminder, especially if you place it on your bathroom mirror or fridge, to be conscious of your spending habits.

- Financial Clarity: By the end of the month, you’ll be surprised at how much money you’ve saved. And those savings? They can go into your emergency fund, be used for a significant amount of money to pay down credit cards, or be steered towards other savings goals.

Maximizing the Benefits of the No Spend Challenge

Digital vs. Physical: While there are digital product versions like specific apps for tracking spending, the tactile nature of a physical product, like our printable planner, offers an unmatched experience. Every time you pick up that pen to fill in a circle, you’re making a conscious decision about your financial situation.

Incorporating the Entire Family: The best way to make this challenge effective is to get everyone on board. Making it a family activity ensures that everyone is working towards a common goal. And hey, kids might find coloring the circles a fun activity!

Savings and Financial Goals: The purpose of a no spend day or month is to change your spending habits over time. You’ll have a clearer picture of where your money goes, helping you tailor your savings and financial goals.

Getting Started

- Download the No Spend Tracker: At the bottom of this article, there’s a link to an instant download of my free printable tracker. Fill in your email address and it will be sent to your email address. The design is simple, efficient, and US letter size. It’s the perfect tool to guide you through your next challenge.

- Set Your Own Rules: While there are some standard spend challenge rules, remember that you can customize this to fit your lifestyle. Whether you’re doing a weekly challenge or aiming for a no spend November, the rules are yours to set!

- Stay Informed and Connected: Join my email list to get great ideas, new spend challenge printables, and to stay updated. And don’t forget to check out my selection results for other free printables!

Important Points to Note

- Digital Nature of this Item: Though the no spend tracker is a digital file, ensure you print it out to make the most of the challenge. Remember, this free printable is for personal use only. Commercial use or reselling is not permitted.

- The Inclusivity of the Challenge: Whether it’s video games, physical items, or even shipping fees for a much-desired product, the no spend challenge encompasses everything. Be strict, but also ensure it’s achievable.

- Don’t Beat Yourself Up: If you notice more red circles than green on your tracker, it’s okay! Learn from it and make the next time better.

Wrapping Up

By the end of the challenge, not only will you be in a better place financially, but you’ll also gain control of your money and spending. The ultimate goal here? Financial freedom. And while the road there might seem tough, tools like our no spend tracker and the consistent effort to avoid excessive spending will make the journey smoother.

So, if you’re embarking on this journey for the first time or even if it’s a recurring effort, remember, every little bit counts. Every green circle you color in on your tracker is one step closer to being on top of your finances.

How to Complete the No Spend Tracker

Utilizing the no spend tracker is straightforward and visually rewarding. For every day you successfully refrain from spending on unnecessary items, color the corresponding circle in a vibrant green.

This serves as a positive affirmation of your discipline. On days where temptation wins and you find yourself spending on non-essentials, mark the day with a bold red.

Over time, this visual representation will not only showcase your progress but also highlight patterns in your spending behavior.

The contrasting colors serve as a quick reference, motivating you to achieve more green days and understand the triggers behind the red ones.

Embrace the tracker as a tool for self-awareness and growth in your financial journey.

Ready to start? Grab the free printable pdf below and let the no spend days roll in!

Frequently Asked Questions

What exactly is a no spend challenge?

A no spend challenge is a commitment to not spend money on unnecessary items for a specific period of time, such as a day, week, or an entire month. The goal is to focus on your spending habits, save a significant amount of money, and ultimately achieve better financial stability.

How does the free printable no spend tracker work?

This free printable tracker is designed to help you keep track of your spending during the challenge. For each day you don’t spend money on unnecessary items, you fill in a circle with green. If you do spend, it’s marked in red. By the end of the month, you’ll have a visual representation of your spending habits.

Can I use this printable for the entire year?

The good news is that this design can be used repeatedly. Print it off each month, or print 12 copies for the whole year!

I see this is a digital product. Can I share it with my family and friends?

The digital nature of this item means it’s available for instant download. However, the free printable is for personal use only. I encourage sharing the product link so they can download their own, but please refrain from commercial use or redistribution.

What if I don’t have a printer for the printable item?

The printable is designed in US letter size, making it suitable for most home printers. If you don’t have a printer, local print shops or libraries often offer affordable printing services.

Can I make my own rules for the no spend challenge?

Of course! While there are general spend challenge rules, the challenge is flexible. Customize it based on your financial situation, monthly bills, and specific goals.

How much money can I expect to save?

The amount varies depending on your usual spending habits. Some have saved just a few dollars, while others have saved a lot of money by the end of the challenge. Every bit counts toward your financial goals, be it clearing credit cards, building an emergency fund, or other savings goals.

Where can I find more such great ideas and free printables?

Join my email list or mailing list to stay updated. Our selection results frequently include new digital items, printable planners, and other resources to help you stay on top of your finances.

I completed my first no spend challenge. When can I start the next challenge?

Congratulations on completing your first challenge! You can start your next challenge whenever you feel ready. Some people prefer back-to-back challenges, while others take a break in between. Find what works best for you.

Remember, the purpose of a no spend day or month is not to deprive yourself but to gain control of your money and work towards financial freedom.

It’s a great way to reflect on unnecessary and unneeded spending and make impactful changes in your life.